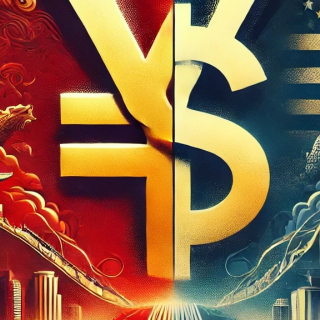

Most Asian currencies weakened on Monday, with the dollar also declining amid heightened fears of a U.S. recession and global economic disruptions from U.S. President Donald Trump's trade tariffs.

The Chinese yuan retreated after Beijing retaliated against the increased tariffs over the weekend, although apparent intervention by the People's Bank of China limited the yuan's decline.

Other Asian currencies weakened sharply as Trump signaled no intent to back down from his plans for sweeping reciprocal tariffs against major global economies.

Dollar tests 6-mth lows; Trump doubles down on tariffs

The dollar index and dollar index futures moved little in Asian trade after sliding to and recovering from a six-month low last week.

Trump over the weekend said his tariffs will remain until the U.S. trade deficit with major economies is rectified.

Trump also appeared unperturbed by a recent slump in global markets, stating that his tariffs were "medicine" for markets.

Trump had last week unveiled plans to impose sweeping tariffs on several major economies, in a bid to pressure them into lowering their tariffs on American goods.

These tariffs are set to take effect from April 9, with Trump warning that tariffs against more sectors were also on the way.

While protectionist policies usually tend to benefit the dollar, the greenback was slammed by heightened concerns over a U.S. recession under Trump. Markets were also seen sharply increasing their bets on more interest rate cuts by the Federal Reserve.

US Treasury yields plummeted on this notion, further denting the dollar.

Chinese yuan slides after Beijing retaliates

The Chinese yuan's USDCNY pair rose 0.4% to its highest level in just over three months on Monday.

This came after Beijing retaliated against Trump's tariffs with a 34% duty on U.S. goods, while also threatening more measures against Washington.

China was among the worst-hit by Trump's tariffs, and is now facing a 54% cumulative tariff on its exports to the U.S.

Such a scenario bodes poorly for the export-reliant Chinese economy, and could also invite more stimulus measures and monetary easing from Beijing to help offset the impact of the tariffs.

But any more monetary easing is likely to further pressure the yuan.

Among broader Asian currencies,the Japanese yen was the sole outlier, briefly hitting a six-month high on increased safe haven demand. The yen was also buoyed by strong wage data, which increases the odds of an interest rate hike by the Bank of Japan.

The USDJPY pair fell 0.4% to 146.31 yen, after sliding as low as 144.82 yen.

The Australian dollar's AUDUSD pair fell 0.3%. Australian Treasurer Jim Chalmers warned that the economy could be impacted by the U.S. tariffs due to its exposure to China, and that he expected many more interest rate cuts from the Reserve Bank of Australia this year.

The South Korean won's USDKRW pair rose 0.5%, while the Indian rupee's USDINR pair was flat around 85.5 rupees. Reports said that India was not planning any retaliation against Trump's tariffs, given that trade talks with Washington were underway.

Source: Investing.com

The U.S. dollar edged up on Wednesday, extending its gains from last week on doubts about the outlook for another Fed rate cut this year and as private payrolls data assuaged worries over the state of...

The US dollar held near a three-month high on Tuesday (November 4th) as a divided Federal Reserve prompted traders to reduce their bets on a rate cut, while the Japanese yen strengthened after a verba...

The US dollar held near a three-month high on Monday (November 3rd) ahead of economic data this week that will provide only vague clues about the health of the US economy and could reinforce the Feder...

The US Dollar Index (DXY) held steady around 99.50 during the Asian session on Friday (October 31st). The greenback's movement was slight as market expectations for a Fed interest rate cut strengthene...

The US dollar traded higher for the second consecutive day against a basket of currencies. The greenback strengthened sharply on Wednesday, following hawkish comments from Fed Chairman Jerome Powell, ...

Gold (XAU/USD) edges lower on Thursday, after briefly reclaiming the key $4,000 psychological mark amid a weaker US Dollar (USD). At the time of writing, XAU/USD is trading around $3,985, easing from an intraday high of $4,019 as bullish momentum...

Silver held around $48.1 per ounce on Thursday, steadying after recent gains as investors digested stronger-than-expected US economic data. The ADP report showed that private employers added 42,000 jobs in October, exceeding forecasts and...

Chicago Federal Reserve President Austan Goolsbee on Thursday said the lack of official data on inflation during the government shutdown "accentuates" his caution about cutting interest rates further. "I lean more to the, when it's foggy, let's...

Asian stocks opened lower on Tuesday, reversing Wall Street's rally fueled by Amazon's massive $38 billion deal with OpenAI. Stock markets in South...

Asian stocks opened lower on Tuesday, reversing Wall Street's rally fueled by Amazon's massive $38 billion deal with OpenAI. Stock markets in South...

Asia-Pacific markets declined on Wednesday, following a decline on Wall Street, which was driven by concerns about the valuations of artificial...

Asia-Pacific markets declined on Wednesday, following a decline on Wall Street, which was driven by concerns about the valuations of artificial...

The Institute for Supply Management (ISM) is scheduled to release its October Services Purchasing Managers' Index (PMI) on Wednesday. The report, a...

The Institute for Supply Management (ISM) is scheduled to release its October Services Purchasing Managers' Index (PMI) on Wednesday. The report, a...

World markets kicked off November in an upbeat mood, riffing off buoyant company earnings and calmer trade relations while batting away OPEC's...

World markets kicked off November in an upbeat mood, riffing off buoyant company earnings and calmer trade relations while batting away OPEC's...